By distributing this form you conform to obtain emails from FinanceBuzz and also to the privateness plan and terms. Associated Examining

You’ll want to be aware of the necessities for borrowing, repayment conditions, and any prospective fees you can find in advance of you have to request an advance.

A wage advance can be a loan that allows you to borrow money from your future paycheck. Fundamentally, you get your income ahead of time.

Get the totally free credit score scoreYour credit score reportUnderstanding your credit history scoreUsing your creditImproving your creditProtecting your credit history

The applications may possibly inspire lousy paying behavior, Because the progress money don’t necessarily need to be put in only in emergencies.

Similarly, using a spend progress signifies you’ll be in financial debt to the job. There’s a very good prospect you’ll really need to fork out back again the progress as well as curiosity immediately if you choose to Stop.

Workers can perspective and ask for their attained wages by way of desktop or maybe the cellular app. When requests are created by midday CT, money are available on precisely the same day.

For those who’re an active federal personnel or member of the uniformed solutions Whenever your loan turns into delinquent, your loan will become a “taxed loan.” A taxed mortgage forever lessens your TSP account Unless of course you pay back it off. Aquiring a taxed financial loan that you've not repaid will cause your ultimate account harmony at retirement to be fewer than it usually would have been.

By using a hard cash advance application, you can more effortlessly prevent overdraft fees by funding your account before it can be overdrawn. A number of of your applications even mechanically address overdrafts.

Genuine overdraft amount may well fluctuate and is particularly subject to change at any time, at Existing’s sole discretion. So as to qualify and enroll during the Fee-Totally free Overdraft function, you need to obtain $500 or even more in Qualifying Deposits into your Current Account more than the preceding thirty-working day interval.

It’s straightforward to offer, way too! Paylocity’s On Demand Payment Remedy usually takes care on the logistics – Money occur from attained wages as well, so there’s minimal impact on here your standard payroll processes.

The Dave application helps you to borrow a small volume of money to deal with fees while you watch for your up coming paycheck or in order to avoid overdrawing your checking account.

Setting up an crisis fund has become the initial ways towards economical wellness. Endeavor to sock absent money if you can, even tiny amounts.

Wage advancements is usually handy in many prospective emergencies, but are they a good idea? Allow’s dive in and see how innovations operate and what possibilities you might have to help you decide if an advance personal loan is best for you.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Anna Chlumsky Then & Now!

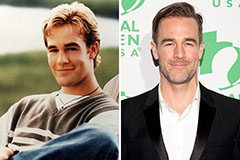

Anna Chlumsky Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!